Learn How to License Our Algorithmic Trading Systems!

Don't Lose Out - Join The Other Traders Maximizing Their Profits with Algo ButtonPublishing

Why Algo Publishing?

Speed & Precision

Algorithms execute trades much faster and more precisely than human traders, resulting in potential price improvement

Consistency & Discipline

Algorithms stick to pre-set rules, helping traders maintain discipline and avoid emotional reactions, like panic selling or greed buying.

Complex Strategies

Execute complex strategies that are impractical for humans, including trading across multiple markets and assets simultaneously.

Reduce Errors & Risk

By automating the order entry process, algorithmic trading reduces the chance of costly manual (and emotional) errors when placing trades

Multi-Market Monitoring

Algorithms monitor prices and market conditions from multiple markets at once, increasing the likelihood of detecting profitable trading opportunities.

Scalability

Algorithms handle and crunch through large volumes of data and trading, allowing the trader to scale their operations effortlessly and tirelessly

Learn How to License Our Algorithmic Trading Systems!

Don't Lose Out - Join The Other Traders Maximizing Their Profits with Algo Publishing

Algorithmic trading

Algorithmic trading operates on pre-set rules designed to make optimal trading decisions. It can execute trades quickly and precisely, at a speed unattainable by human traders. Further, algorithmic trading allows the trader to implement complex strategies that can trade on multiple markets or assets simultaneously, a task that would be arduous and prone to error manually.

Algorithmic trading also helps mitigate the risk of price slippage and avoids the cost of the order impact on the market, by slicing large orders into smaller ones for execution. It is designed to work 24/7, unlike humans who need to sleep and rest, thus maximizing all potential trading opportunities.

As algorithms are emotion-free, they also prevent the under or over-trading which sometimes happens due to human emotional responses, offering a potentially more disciplined approach to trading.

Trading Reimagined

Leverage the power to trade like a financial industry titan, right from the comfort of your own home. Algo Publishing offers you advanced, state-of-the-art algorithmic trading strategies, bringing Wall Street's capabilities directly to your doorstep.

Unlock the full potential of your investments using our cutting-edge system that's designed to seek out profit in lightning-fast timeframes. Our technology tirelessly scans multiple markets and assets, ensuring no opportunity escapes its watchful eyes.

But don't worry — you don't need to be a math whiz to get started. At Algo Publishing, we've designed our system to be user-friendly, whether you're a seasoned trader or just getting your feet wet in the world of stock trading.

Step into the future of trading with Algo Publishing. Experience faster trades, precise execution, and the chance to maximize your profits like never before.

Ready to transform the way you trade?

Algo Publishing is a Shortcut

Algo Publishing is your ultimate trading shortcut. By leveraging cutting-edge technology and advanced mathematical models, you're no longer restrained by traditional trading's time-consuming and often emotionally driven constraints.

Algorithmic trading accelerates your journey to profits by rapidly identifying opportunities, executing trades with precision, and monitoring multiple markets around the clock.

It breaks down complex processes into seamless operations, tackling strategies that would typically consume significant time and resources.

With this significant speed and efficiency increase, combined with dramatically reduced potential for human error, algorithmic trading is truly the shortcut to smarter, faster, and more profitable trading. Embrace the future of trading and steer your pathway to accelerated financial success with algorithmic trading.

Experience The Future of Investing, Today

With Nurp's Powerful Investing Software

What is the

Algorithmic Trading Accelerator

Access to 4 High-Performance Trading Algorithms

Get Access To Regular Market Updates

No Prior Trading Experience Required

24-hour Weekday Email & Phone Support

PLUS, Lifetime Access to ALL Future Algorithms!

Algorithmic trading

Algorithmic trading operates on pre-set rules designed to make optimal trading decisions. It can execute trades quickly and precisely, at a speed unattainable by human traders. Further, algorithmic trading allows the trader to implement complex strategies that can trade on multiple markets or assets simultaneously, a task that would be arduous and prone to error manually.

Algorithmic trading also helps mitigate the risk of price slippage and avoids the cost of the order impact on the market, by slicing large orders into smaller ones for execution. It is designed to work 24/7, unlike humans who need to sleep and rest, thus maximizing all potential trading opportunities.

As algorithms are emotion-free, they also prevent the under or over-trading which sometimes happens due to human emotional responses, offering a potentially more disciplined approach to trading.

Trading Reimagined

Leverage the power to trade like a financial industry titan, right from the comfort of your own home. Algo Publishing offers you advanced, state-of-the-art algorithmic trading strategies, bringing Wall Street's capabilities directly to your doorstep.

Unlock the full potential of your investments using our cutting-edge system that's designed to seek out profit in lightning-fast timeframes. Our technology tirelessly scans multiple markets and assets, ensuring no opportunity escapes its watchful eyes.

But don't worry — you don't need to be a math whiz to get started. At Algo Publishing, we've designed our system to be user-friendly, whether you're a seasoned trader or just getting your feet wet in the world of stock trading.

Step into the future of trading with Algo Publishing. Experience faster trades, precise execution, and the chance to maximize your profits like never before.

Ready to transform the way you trade?

Algo Publishing is a Shortcut

Algo Publishing is your ultimate trading shortcut. By leveraging cutting-edge technology and advanced mathematical models, you're no longer restrained by traditional trading's time-consuming and often emotionally driven constraints.

Algorithmic trading accelerates your journey to profits by rapidly identifying opportunities, executing trades with precision, and monitoring multiple markets around the clock.

It breaks down complex processes into seamless operations, tackling strategies that would typically consume significant time and resources.

With this significant speed and efficiency increase, combined with dramatically reduced potential for human error, algorithmic trading is truly the shortcut to smarter, faster, and more profitable trading. Embrace the future of trading and steer your pathway to accelerated financial success with algorithmic trading.

Experience The Future of Investing, Today

With Nurp's Powerful Investing Software

What is the

Algorithmic Trading Accelerator

Access to 4 High-Performance Trading Algorithms

Get Access To Regular Market Updates

No Prior Trading Experience Required

24-hour Weekday Email & Phone Support

PLUS, Lifetime Access to ALL Future Algorithms!

STILL NOT SURE?

Frequently Asked Questions

What exactly is algorithmic trading?

Algorithmic trading is a method of executing orders using automated pre-programmed instructions considering variables like time, price, and volume to send small slices of the order to the market over time.

Do I need programming knowledge for algorithmic trading?

While having some programming knowledge can be useful for developing personalized strategies, many algorithmic trading platforms are user-friendly and require minimal coding experience.

How fast are trades executed in algorithmic trading?

Trade execution is almost instantaneous in algorithmic trading, and it happens faster than any human could manually place a trade.

Does algorithmic trading completely eliminate the risk of losses?

No, while algorithmic trading can minimize errors and manage risks, it cannot entirely eliminate the potential for losses. Market volatility and strategy effectiveness still play significant roles.

Can algorithmic trading lead to overtrading?

Because algorithmic trading operates on pre-set rules, it actually helps prevent overtrading by only executing trades when the specified conditions are met.

Is algorithmic trading only suitable for large financial institutions?

Not at all. While large firms were the early adopters, technological advancements have made algorithmic trading accessible and advantageous for individual traders as well.

What is slippage in algorithmic trading?

Slippage refers to the difference between the expected price of a trade and the price at which the trade is executed. Algorithmic trading often reduces slippage because it executes trades so quickly.

Does Algo Publishing systems work 24/7?

Yes. Algorithmic trading systems can work all day and night, ensuring that no trading opportunity is missed even when markets are closed in your time zone.

How do I test the effectiveness of an algorithmic trading strategy?

Traders usually backtest their strategies on historical and real-time data. Many algorithmic trading platforms provide backtesting facilities.

Does algorithmic trading render fundamental analysis irrelevant?

Not necessarily. While algorithmic trading often relies heavily on technical analysis, many systems incorporate aspects of fundamental analysis, like news events or earnings reports. As a trader, you will decide what factors to include in your trading strategy.

Learn How to License Our Algorithmic Trading Systems!

Don't Lose Out - Join The Other Traders Maximizing Their Profits with Algo Publishing

Discover Nurp’s Game-Changing Trading Tools – Tailored for Your Success

Select your program

See if you qualify

Start trading faster than you ever have before

ATA Lite

ATA PRO

The Signal Suite

Simple Start

One Time Enrollment Fee!

Lifetime Program Membership!

Full Access to 2 Pre-Selected Trading Algorithms of Your Choice

24/5 Email and Phone Support

Weekly Office Hours on ZOOM: Monday – Friday

ATA LITE Course Material

Regular Market Updates

Access to Community Discussions

Accounts cannot hold more than $50,000

Harness the Power of ATA Lite Today!

Simple Start

One Time Enrollment Fee!

Lifetime Program Membership!

Full Access to 2 Pre-Selected Trading Algorithms of Your Choice

24/5 Email and Phone Support

Weekly Office Hours on ZOOM: Monday – Friday

ATA LITE Course Material

Regular Market Updates

Access to Community Discussions

Accounts cannot hold more than $50,000

Harness the Power of ATA Lite Today!

Simple Start

One Time Enrollment Fee!

Lifetime Program Membership!

Full Access to 2 Pre-Selected Trading Algorithms of Your Choice

24/5 Email and Phone Support

Weekly Office Hours on ZOOM: Monday – Friday

ATA LITE Course Material

Regular Market Updates

Access to Community Discussions

Accounts cannot hold more than $50,000

Harness the Power of ATA Lite Today!

Unleash Your Profit Potential with Cutting-Edge Algorithmic Trading Solutions

Why Algo Publishing?

Speed & Precision

Algorithms execute trades much faster and more precisely than human traders, resulting in potential price improvement

Consistency & Discipline

Algorithms stick to pre-set rules, helping traders maintain discipline and avoid emotional reactions, like panic selling or greed buying.

Complex Strategies

Execute complex strategies that are impractical for humans, including trading across multiple markets and assets simultaneously.

Reduce Errors & Risk

By automating the order entry process, algorithmic trading reduces the chance of costly manual (and emotional) errors when placing trades

Multi-Market Monitoring

Algorithms monitor prices and market conditions from multiple markets at once, increasing the likelihood of detecting profitable trading opportunities.

Scalability

Algorithms handle and crunch through large volumes of data and trading, allowing the trader to scale their operations effortlessly and tirelessly

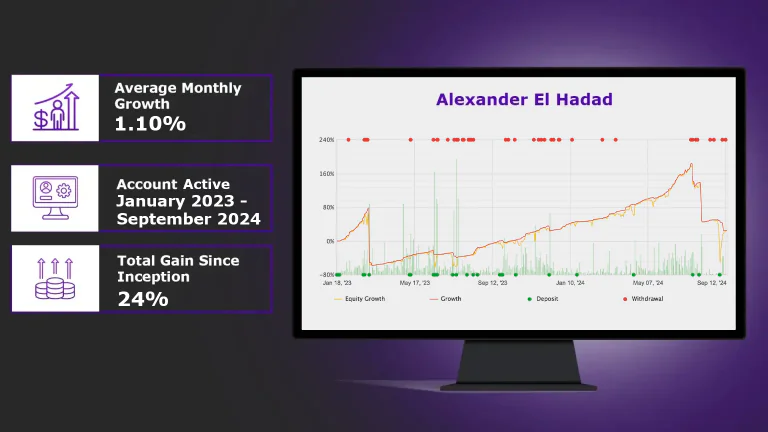

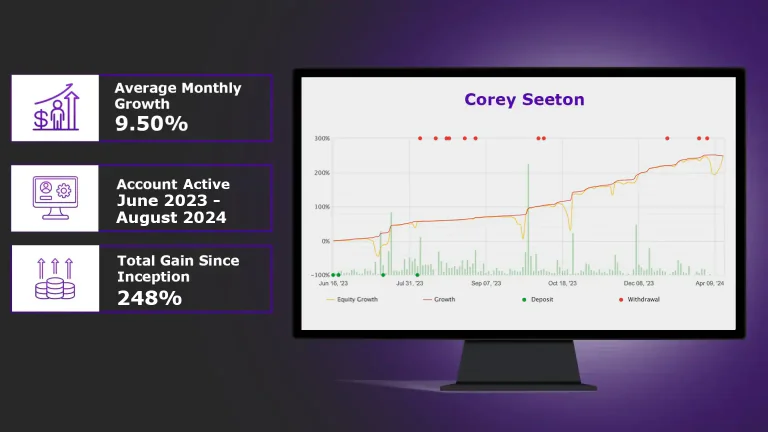

Real Users, Real Results

Discover Nurp, Discover The Future

Disclosure: PAST PERFORMANCE IS NOT A RELIABLE INDICATOR OF FUTURE RESULTS. For important information and disclosures, please visit Nurp.com/disclosure/

Algorithmic Trading Accelerator: Beating The Markets Even In Your Sleep

Algorithmic Trading Accelerator: Where standout, best in class results compound into laughably good returns as our customers report. See our Case Study, an in-depth analysis of how one of our top performing accounts grew by more than 460% since inception

Financial Empowerment Starts With Wisdom

Wisdom: Where knowledge translates into financial power.

Mastering Market Data Analysis for Algo Trading

10 Hard-Hitting Lessons Gold Traders Should Steal from the Forex Playbook

Dollar Extends Gains Amid Rising U.S. Yields and Economic Optimism

Decision Fatigue in Trading: Algorithms vs Human Emotions

Ready to Accelerate Your Trading Journey?

Unleash your full trading potential with Nurp's powerful algorithms, insights, and supportive community.

Quantum leap your investments and join the revolution democratizing algorithmic access.

Quick Links

Helpful Links

Let's Connect!

IMPORTANT NOTICE! No representation is being made that the use of this strategy or any system or trading methodology will generate profits. Past performance is not necessarily indicative of future results. There is substantial risk of loss associated with trading securities and options on equities. Only risk capital should be used to trade. Trading securities is not suitable for everyone. Disclaimer: Futures, Options, and Currency trading all have large potential rewards, but they also have large potential risk. You must be aware of the risks and be willing to accept them in order to invest in these markets. Don’t trade with money you can’t afford to lose. This website is neither a solicitation nor an offer to Buy/Sell futures, options, or currencies. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed on this web site. The past performance of any trading system or methodology is not necessarily indicative of future results.

CFTC RULE 4.41 – HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.

Copyright © 2024 QuantLeap Technologies, LLC | All Rights Reserved.